The Complete Disclosures Report includes each of the required ASC 842 or IFRS 16 Reports rolled up into one consolidated report.

- Complete Disclosure Report - ASC 842

- Complete Disclosure Report - IFRS 16

- Frequently Asked Questions

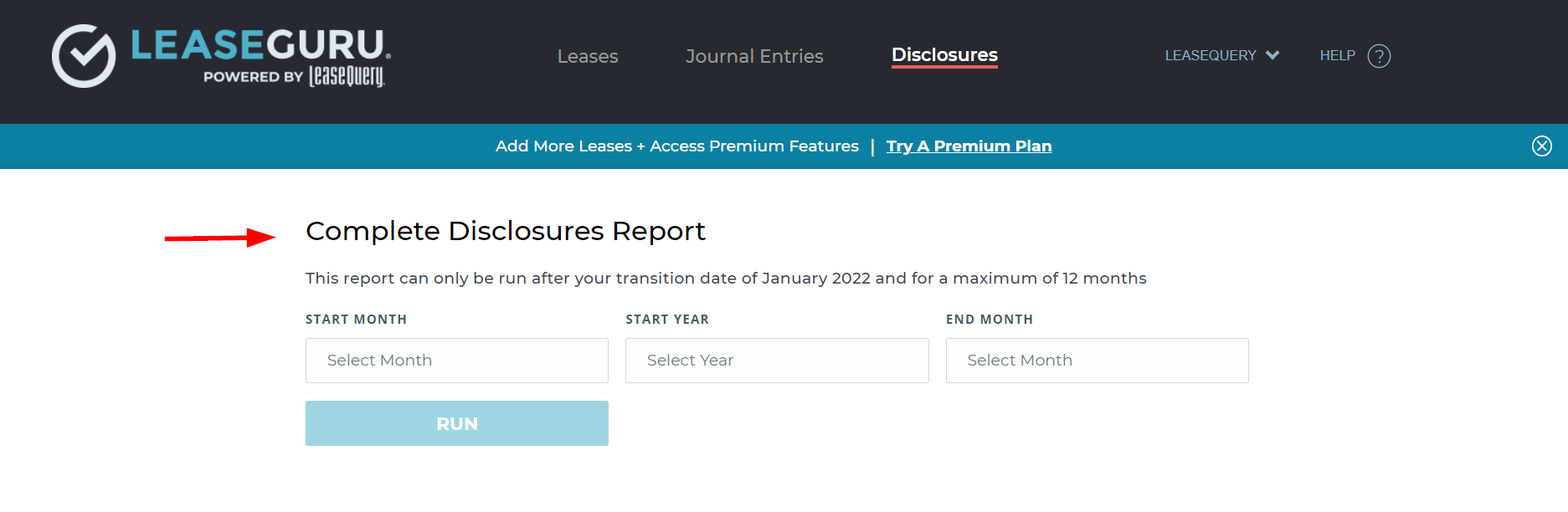

Note: The date range for this report cannot exceed one year.

Complete Disclosure Report - ASC 842

The Complete Disclosures Report will provide the totals of all the required disclosures. These disclosures include:

- Amortization of ROU Assets – Finance Leases: Reports the total accumulated amortization for the reporting period.

- Under ASC 842, the Amortization of Right Of Use (ROU) Asset Report is a required disclosure. The lessee takes the sum of depreciation expense for the 12 months for all finance (previously capital under ASC 840) leases.

-

Interest on Lease Liabilities:Reports the total interest expense for finance leases for the reporting period.

-

Under ASC rule 842, companies are required to disclose the interest expense recorded over the past 12 months.

-

-

Operating Lease Cost (Cost resulting from Lease Payments): Reports the total lease expense (operating leases) for the reporting period.

-

Operating lease cost is the cost associated with lease components, known as the straight-line expense. Under ASC rule 842, companies must disclose the sum of straight-line expense or operating lease cost across the past 12 months.

-

-

Variable Lease Cost (Cost Excluded from Lease Payments): Reports the variable lease costs for the reporting period

-

Variable lease costs are additional payments a lessee is required to make according to the lease agreement. These payments are reconciled and trued-up throughout the life of the lease, and thus are variable in nature. This can include common area maintenance (CAM), tax, insurance, etc. These payments do not affect the ROU asset but are still required to be disclosed.

-

-

Finance Lease – Operating Cash Flows: Reports the total interest expense associated with cash payments. If no cash payment is made, interest expense is not included in the calculation.

- Finance Lease – Financing Cash Flows: Reports the total liability reduction for finance leases for the reporting period.

- Financing cash flow statements are financing activities that impact a company’s owners and creditors. Companies will sum all lease liability debit entries made throughout the year. Under ASC rule 842, public and non-public companies are required to disclose the consolidated balance of those lease liability debit entries for all finance (previously capital under ASC rule 840) leases.

-

Operating Lease – Operating Cash Flows (Fixed Payments): Reports the total fixed cash payments for the reporting period.

-

Operating cash flows statements represent core activities related to the operations of the business. Under ASC rule 842, public and non-public companies are required to disclose the consolidated balance of those interest expense entries for all operating leases.

-

-

Operating Lease – Operating Cash Flows (Liability Reduction): Reports the total positive liability reduction for operating leases for the reporting period.

-

New ROU Assets – Finance Leases: The beginning asset balance is calculated as the net asset balance plus the lease asset expense.

-

Weighted Average Lease Term – Finance Leases: Reports the total lease liability for all finance leases and the average of the remaining term. Omit everything else. It’s not consistent with the other report descriptions.

- Weighted Average Lease Term – Operating Leases: Reports the total lease liability for all operating leases and the average of the remaining term. Omit everything else. It’s not consistent with the other report descriptions.

-

Weighted Average Discount Rate – Finance Leases: Reports the total remaining lease payments for finance leases and the proportional rate for the remaining term. Omit everything else. It’s not consistent with the other report descriptions.

-

Weighted Average Discount Rate – Operating Leases: Reports the total remaining lease payments for operating leases and the proportional rate for the remaining term. Omit everything else. It’s not consistent with the other report descriptions.

Complete Disclosure Report - IFRS 16

The Complete Disclosures Report - IFRS will provide the totals of all the required disclosures. These disclosures include:

- New ROU Assets– Total Additions from Gross Asset Balance Rollforward Breakout

- Carrying Amount of ROU– Carrying Value from Carrying Value of ROU report broken out by classification

- Ending Lease Liability Balance– Ending balance from Liab. Rollforward Breakout for same date range

- Depreciation Expense– Total additions from Depreciation of ROU Assets - IFRS report

- Interest on Lease Liabilities– Interest on Lease Liabilities - IFRS report

- Financing Cash Flows – Financing Cash Flows - IFRS report

- Short-term Lease Cost -sum the expense for a given period for all short-term leases.Short-term Lease Cost - IFRS Report

- Variable Lease Cost –Variable Lease Cost (Cost excluded from lease payments) – IFRS report

- Low-Value Lease Expense -will aggregate the lease expense related to low-value assets but exclude any expense related to short-term leases of low-value assets.Low Value Asset Lease Expense - IFRS 16

The date range for this report cannot exceed one year. The report can only be viewed by Total Organization.

Frequently Asked Questions about the Complete Disclosure Report

- Can I export the complete disclosure report? No, at this time if you wish to export this report, then you will need to consider upgrading to LeaseQuery Essential.

- Does LeaseGuru provide qualitative disclosure reports? No, LeaseGuru only provides this quantitative complete disclosure report.